Debt, sorted.

Money issues in your past shouldn't decide your future.

As a UK debt collection company, we work with customers every day to sort their debt, and get on with their lives.

Debt, sorted.

Money issues in your past shouldn't decide your future.

As a UK debt solutions company, we work with customers every day to sort their debt, and get on with their lives.

Our promises

- We won’t charge interest or fees while you work with us on your account(s)

- We will listen more than we talk

- We’ll work with you on a way forward

- You’re in control of your repayment

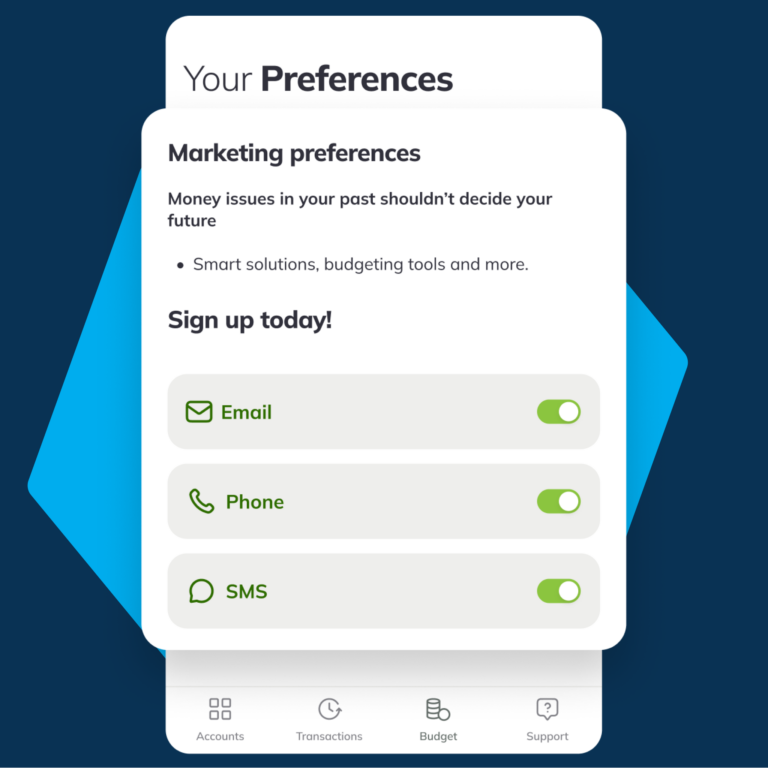

Money issues in the past shouldn't decide your future.

At PRA Group (UK) we want to support your financial wellbeing.

Sign up to receive updates on tools, budgeting support, and upcoming products and services that could help you meet your needs and goals.

Your plan,

your way.

With PRA Group you’re in control. Log in and use our payment plan tool to play with some options – no strings attached.

About us

Who we are and what we do.

PRA Group is one of the UK’s largest debt purchasers and collectors. PRA Group (UK) Limited and PRA Group UK Portfolios Ltd are subsidiaries of PRA Group, Inc.—a publicly-traded (Nasdaq: PRAA) company which started in 1996 and employs around 3,000 people across the Americas and Europe.

We are focused on running a business with a highly ethical code of conduct and PRA Group only buys accounts from reputable high street providers. PRA Group (UK) Limited has been instructed by PRA Group UK Portfolios Ltd to manage your account on their behalf.

As debt solution specialists, PRA Group offers our customers solutions for getting out of debt and repairing their credit history. We don’t attempt to collect from those who can’t pay. We don’t add interest or fees while you work with us on your account(s).

We are committed to helping our customers repay their outstanding balance in accordance with their ability to pay. At PRA Group we know life happens and doesn’t always go according to plan. Making contact is the first step to a brighter future. We are committed to working together.

PRA Group purchases large numbers of debt accounts from many major banks and finance companies. These banks and finance companies chose to sell their accounts on to debt purchase companies like PRA Group, usually when the account has gone into default.

This is good news, as PRA Group specialises in working with customers to help them resolve their debt and repair their credit history.

We are here to help you understand the process and your options. Most importantly, we are committed to working together to come to the most appropriate resolution, and any payment plans we agree should be both sustainable and affordable.

Want to find out more about how debt repayment works?

Testimonials

How customers have dealt with debt.

“I felt you really listened to me explaining my situation..."

"Thank you to all the staff who have helped me over the years..."

Common questions

PRA Group is one of the UK’s largest debt purchasers and collectors. PRA Group (UK) Limited and PRA Group UK Portfolios Ltd are subsidiaries of PRA Group, Inc.—a publicly-traded (Nasdaq: PRAA) company which started in 1996 and employs around 3,000 people across the Americas and Europe.

We are focused on running a business with a highly ethical code of conduct and PRA Group only buys accounts from reputable high street providers. PRA Group (UK) Limited has been instructed by PRA Group UK Portfolios Ltd to manage your account on their behalf.

As debt solution specialists, PRA Group offers our customers solutions for getting out of debt and repairing their credit history. We don’t attempt to collect from those who can’t pay. We don’t add interest or fees while you work with us on your account(s).

We are committed to helping our customers repay their outstanding balance in accordance with their ability to pay. At PRA Group we know life happens and doesn’t always go according to plan. Making contact is the first step to a brighter future. We are committed to working together.

PRA Group purchases large numbers of debt accounts from many major banks and finance companies. These banks and finance companies chose to sell their accounts on to debt purchase companies like PRA Group, usually when the account has gone into default.

This is good news, as PRA Group specialises in working with customers to help them resolve their debt and repair their credit history.

We are here to help you understand the process and your options. Most importantly, we are committed to working together to come to the most appropriate resolution, and any payment plans we agree should be both sustainable and affordable.

All PRA employees share a common set of values and commitments that define how we treat each other, how we relate to our customers, and the responsibilities we have to shareholders, regulators, clients, and others. Simply put, they’re the principles that reflect our company’s culture, why PRA was started, and who PRA is today. Our goal is for every PRA employee to personalise and live these shared values—because they are guidelines for everything we do.

COMMITTED to always doing our best work.ACCOUNTABLE for our actions.

RESPECTFUL in our interactions with each other.

ETHICAL in every situation.

SUCCESSFUL because we work together as a team.

Login to find out information on managing your PRA Group account. You only need your name, date of birth and postcode, or reference number & password, from a PRA Group letter to view your account and make a payment. Learn more.

We offer many different payment methods & it’s your decision which you use.

You’ll find your account information on any letter we’ve sent you, including reference number, balance, original creditor and online log in details. Use your name, date of birth and postcode, or reference number & password, from a PRA Group letter to view your account, make a payment or set up a payment plan today. Login.

March 2026

Get timely, relevant information about debt and how to deal with it.